Electric vehicles (EVs) experienced a watershed year in 2021, achieving 6.6 million units in global sales. This represents a remarkable 109% year-over-year increase according to EV Volumes data, buoyed by recovering consumer demand post-pandemic coupled with amplifying government support worldwide for incentivizing EV purchases combined with charging infrastructure build-outs.

Industry analysts widely expect the EV momentum to accelerate through 2023 and beyond thanks to numerous interlocking trends centered around improving technology, shifting regulations, expanding model availability and growing public acceptance.

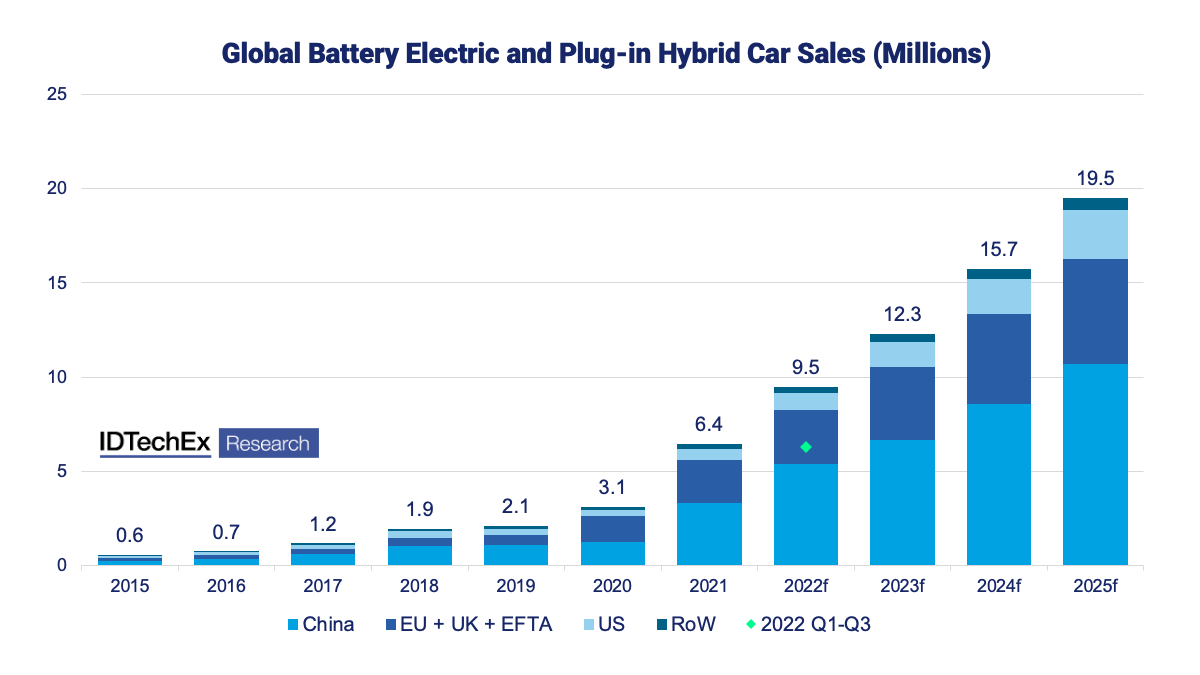

Soaring Global EV Sales Projected

Electric vehicle sales are forecasted to grow 35% year-over-year reaching 8.5 million units globally during 2023 according to IDTechEx projections. Their data suggests 2023 will likely constitute the first year EV sales volumes surpass diesel vehicles worldwide – representing a meaningful macro shift toward vehicle electrification.

Many countries already announced phase out targets for new internal combustion engine (ICE) vehicle sales occurring between 2030 and 2040. Norway leads in EV adoption having already achieved over 80% BEV market share of 2022 new car sales.

China Remains Key Growth Engine

To date, China represents the single most important geography driving EV adoption at scale globally. In 2021, Chinese consumers purchased over 3 million EVs, capturing a dominant 46% share of the global EV market according to S&P Global Mobility. For 2023, experts predict China expanding market share beyond 50% as government incentives continue encouraging EV purchases relatively more than other nations.

Domestic automakers like BYD, Great Wall and NIO actively disrupt foreign rivals by tailoring EV models catering to mainstream Chinese consumer preferences and tight budgets. And China’s extensive investment in dense public charging infrastructure alleviates range anxiety concerns, further powering adoption.

United States Ramping Policy Support

Thanks to the Inflation Reduction Act passed in 2022, EV purchase incentives in the US now reach up to $7,500 per vehicle for meeting specific MSRP and domestic manufacturing requirements. This federal policy support comes in addition to complimentary state-level rebates like California’s $2,000 incentive for going electric.

However, the US EV market continues playing catch up to China and Europe, hampered by legacy auto manufacturers only recently getting serious around fleet electrification commitments. American EV market share sat at meager 13% during 2021 constituting just 0.88 million units sold domestically. But US EV sales are projected multiplying nearly 250% by 2023 if automakers execute on promised model rollouts spanning affordable segments.

Tesla Retains Market Leader Position

At nearly 1.3 million EVs sold last year, Tesla continues firmly commanding the top global EV seller position in 2021 enjoying roughly 24% total market share according to EV Volumes. Chinese budget EV specialist BYD trails at second place having shipped over 0.9 million electric vehicles in 2021. And the Volkswagen Group fills the third spot thanks to nearly 0.57 million EV unit deliveries last year across their Audi, Porsche, Volkswagen and Skoda brands.

But legacy brands like VW and GM rapidly introduce dozens of fresh EV models during 2023 and beyond, potentially shaking up current market share dominance. Nevertheless, Tesla appears strategically positioned to lead for years thanks continuing high demand outpacing their production scale-up roadmaps.

Key EV Adoption Drivers

Industry experts recognize four primary interrelated factors responsible for spurring electric vehicle sales volume globally post-pandemic into 2023:

1. Government Incentives & Investments

In addition to lucrative consumer purchase rebates or tax credits offered in dozens of countries now, governments around the world newly allocate billions into public EV charging infrastructure expansions to help enable wider adoption by alleviating range anxiety concerns.

For example, the recently passed US Infrastructure Investment and Jobs Act earmarks $7.5 billion for constructing an expected 500,000 EV chargers nationwide by 2030. The UK also commits £1.3 billion for electric vehicle charging infrastructure upgrades.

Targeted investments into charging stations signal leadership commitment toward vehicle electrification goals, further de-risking purchases in the minds of mainstream consumers hesitant around new EV technology.

2. Falling Lithium-Ion Battery Prices

Arguably the most pivotal catalyst accelerating electric vehicle demand traces directly to immense cost improvements in lithium-ion battery packs while density significantly improves – dropping 89% from 2010 to 2021.

And battery cells continue packing more range each successive year allowing automakers stretching into attractive 400+ mile segments as new chemistries get commercialized.

Industry consensus suggests battery pack prices will breach the psychological $100 per kWh commercial tipping point by 2024. Hitting this milestone proves critical for EVs reaching upfront price parity with gasoline vehicle counterparts across mainstream segments without subsidies.

3. Expanding Model Selections

Early electric vehicle offerings spanned relatively niche luxury segments from startup brands like Tesla and Lucid. But all mainstream automakers now commit serious capital toward launching dozens of affordable EV models by 2025.

General Motors alone targets delivery of 30 different electric models globally by mid-decade tailored to mass market preferences spanning functionality, price points and range configurations – including the revolutionary $30k Equinox EV boasting over 300 miles range.

These new introductions across identifying body styles, features sets and consistent availability finally bring EVs fully into the mainstream with options precisely matching gasoline counterparts favored by average consumers.

4. Improving Range and Charging Speed

While most current EV owners charge daily at home, public visibility for ubiquitous ultra-fast charging stations signals confidence in completing long trips similar to gas vehicles.

Next generation EVs under development already promise charging rates reaching 400+ kW enabling adding hundreds of miles over just 15 minutes. This charging convenience kills deceptive myths around EVs imposing long charging waits on road trips.

In parallel, production EVs due in 2024 now target consuming 20% less energy per mile thanks to aerodynamic efficiencies, low rolling resistance tires and advanced heat pumps reducing HVAC loads – together delivering real-world ranges approaching 500 miles per charge.

Regional EV Market Share Analysis

Market data analyzed by IDTechEx finds that electric vehicle adoption rates diverge noticeably across prominent global regions during the next five years thanks to contrasting policy frameworks.

China Dominates Through Sheer Scale

China stands alone from a market penetration standpoint through 2027 thanks to unrivaled scale effects from enormous yet still growing consumer demand buoyed by favorable domestic purchase incentives.

Chinese government industrial plans also spotlight vehicle electrification as catalyst for accelerating technical self-reliance – especially across mineral supply chains feeding millions of battery packs required this decade.

Europe Leads on Per Capita Basis

Europe currently leads the globe from a per capita EV adoption basis thanks to progressive government emissions regulations coupled with higher fuel taxation nudging consumers away from gasoline vehicles.

Wealthy European nations offer among the most generous consumer purchase incentives globally – slashing thousands off EV sticker prices. Nations like Norway already achieve EV penetration exceeding 85% of new 2022 car sales.

United States Playing Catch Up

The US electric vehicle market lags European and Chinese demand levels on both absolute and per capita basis. But new federal subsidies via the IRA Act plus improving model options might enable closing gaps during the latter half of this decade.

However,片 the US must overcome structural disadvantages around sprawl inducing longer average commute distances for feasibly electrifying all passenger vehicles. Assuring convenient rural fast charging also proves challenging across its vast geography.

Future EV Growth Projections

Most industry analysts and government agencies publish relatively consistent bullish outlooks for global electric vehicle sales volumes multiplying severalfold through the 2020s – assuming most technological and policy trajectories persist at current momentum.

Here’s a brief survey of prominent EV adoption forecasting models:

BloombergNEF: 34% CAGR Through 2030

Influential clean energy forecaster BloombergNEF sees global electric vehicle sales accelerating from 6.6 million units in 2021 to 26.8 million by 2025, then further expanding at a 34% compounded annual growth rate (CAGR) to 54 million EVs sold in 2030. This equates to roughly 50% share of all passenger vehicle sales worldwide by the end of this decade.

China leads the globe in EV adoption by 2030 at 57% penetration domestically. Europe follows second at 52% EV sales share regionally, trailed by the US reaching 51% by that timeframe in the BloombergNEF model.

IEA: 41% CAGR by 2030

The highly regarded International Energy Agency (IEA) updated their optimistic EV outlook in 2022 forecasting global sales volumes multiplying by 41% compounded annually this decade – expecting 80 million EVs to sell globally by 2040.

IEA analysis sees electric models likely constituting 60% of all new car sales worldwide by 2030. Key policy assumptions underpinning growth include accelerating bans on internal combustion engine vehicles across additional nations by 2035.

McKinsey: 58% CAGR by 2030

Management consultancy McKinsey revised their EV projections slightly downwards in mid-2022 primarily on concerns around near-term lithium-ion battery supply constraints and raw material bottlenecks limiting fulfilled demand until factories scale up.

But their latest global EV forecast still sees brisk 52% year-over-year sales growth in 2023 followed by a 58% CAGR through the end of this decade – hitting roughly 60 million annual units by 2030. McKinsey thinks China expands EV market share the fastest, capturing 54% of volume by that year.

Market Share Leaderboard Shifting

While Tesla firmly led the industry in electric vehicles delivered during 2021, legacy automakers like the Volkswagen Group rapidly ramp up dozens of fresh EV models targeting high volume segments – likely reshuffling market share standings in 2023 and beyond.

Here’s a brief synopsis of top players angling for electric vehicle dominance during the next critical years:

Tesla Retains Market Leads Near Term

The EV pioneer positioned best to lead industry sales this year and next remains Tesla thanks to demand still outpacing their 50% annual production expansion plans targeting 1.8 million deliveries in 2023. Global capacity scaling towards 3 million units mid-decade bodes well for significan market share retention.

Cybertruck full-scale production also starts next year, unlocking a lucrative light-duty pickup segment where rivals lag behind in candid Tesla-competitive EV truck offerings.

VW Group Prioritizes Global EV Scale

Still reeling from its 2015 diesel emissions cheating scandal, Volkswagen AG seeks redemption by committing €52 billion (~$55 billion) during the next five years toward vehicle electrification programs spanning every production asset and consumer price band – more than any rival.

But complex vehicle platforms and scattered regional operations slows their ambitious 11 million EV unit sales target by 2030, likely limiting near-term market share expansion until comprehensively rearchitected ME BEV platform reaches high-yield maturity after 2025.

BYD Leads Chinese Market on Frugal Innovations

With buoyant domestic demand trends in its favor, seasoned Shenzhen-based EV maker BYD appears best positioned among Chinese manufacturers toward sustaining market leadership regionally thanks continuing world-class vertical integration capabilities into battery tech and an unmatched track record stretching back decades delivering appealing yet affordable EV models preferred by mainstream buyers there.

2023 sees BYD expanding overseas exports toward Western markets, leveraging manufacturing and supply chain lessons learned through intense localization – posing legitimate near-term threats stealing share from costlier European and American brands.

Stellantis Wakes Up To Embrace Electrification

Recently merged Stellantis – born from Fiat Chrysler and PSA Peugeot Citroen – plays catch up toward credible electric vehicle industrialization despite its sheer size and 14 storied brands.

2023 becomes a pivotal year for righting the ship on electrification via multi-billion dollar joint ventures securing domestic US and EU battery supply alongside flexible multi-brand platforms standardized for economical EV assembly across European and North American production networks – hopefully jumpstarting sales prior the 2025 tipping point.

Key Takeaways

The latest data leaves industry observers confidently predicting a breakout year in 2023 for global electric vehicle sales thanks to improving economics, model diversity, charging infrastructure and steady regulatory tailwinds worldwide nudging automakers into record electrified vehicle production commitments this decade.

Here are three core insights summing up the 2023 Global EV Adoption Report:

1. 2023 Extends Breakout 2021 Growth Trajectory

All indicators point toward 2023 amplifying 2021’s watershed EV delivery volumes, likely surpassing 8.5 million units globally on 35% year-over-year gains – handily beating pre-pandemic 2019 levels. Consensus forecasts now regularly predict soaring compound annual growth rates ranging from 38% to 58% worldwide through 2030.

2. China Remains Primary Regional Driver

China single-handedly moves the needle more than any other geography thanks to world-leading domestic demand trends reinforced by industrial policy priorities across transport electrification – likely capturing over 50% of all EV sales globally this year. Chinese automakers also position well serving overseas emerging markets thanks to cost innovation advantages.

3. More Models Crucial for Mainstream Appeal

While government incentives temporarily reduce upfront sticker prices today, near term EV cost competitiveness against gasoline counterparts still relies primarily upon chemistry improvements yielding cheaper, denser batteries coupled with scale manufacturing benefits across simplifying platforms.

Fortunately nearly all brands now invest tens of billions into model range diversity spanning functionalities and configurations precisely aligning consumer expectations during this pivotal 2025-2027 conversion window as battery prices reach equivalence.

In summary, the latest EV adoption report paints a bullish outcome for soaring electric vehicle sales during the 2020s thanks to improved economics and industrial commitments trending well ahead of initial policy deadlines across key markets like China, Europe and North America. The future clearly belongs to well-orchestrated electrons over dinosaur remains.

Leave a Reply