Electric vehicles (EVs) and hybrids achieve their remarkable efficiencies largely thanks to advanced high-capacity battery packs powering the electric drivetrains. Unlike gas engines with simple fuel tanks, EV batteries come in a variety of underlying architectures and chemical formulations – each with their own manufacturing traits that confer specific performance advantages and tradeoffs.

Understanding EV battery terminology gives key insights into why different electric vehicles deliver varying driving ranges, durability, charging speeds, and overall value. Let’s explore the most common battery chemistry types found in today’s top selling production electric cars and hybrids along with promising future alternatives still under development.

Key EV Battery Performance Factors

Before detailing specific composition differences, we must highlight the core performance factors influenced by battery chemistry choice and cell development:

Driving Range – Total miles capable per full charge based on battery capacity and efficiency

Durability – Stable charging capacity over thousands of cycles and years

Recharge Rate – Speed battery can safely absorb charging current to minimize fill-up times

Energy Density – Total energy storage per unit volume; directly influences range capabilities

Specific Energy – Energy capacity relative to battery mass – key for vehicle handling

Thermal Sensitivity – Resilience of charging traits and life cycles across temperature swings

Production Scalability – Manufacturing complexity and costs influence viability for mass market vehicles

Now let’s explore how popular EV battery types compare across these crucial performance traits…

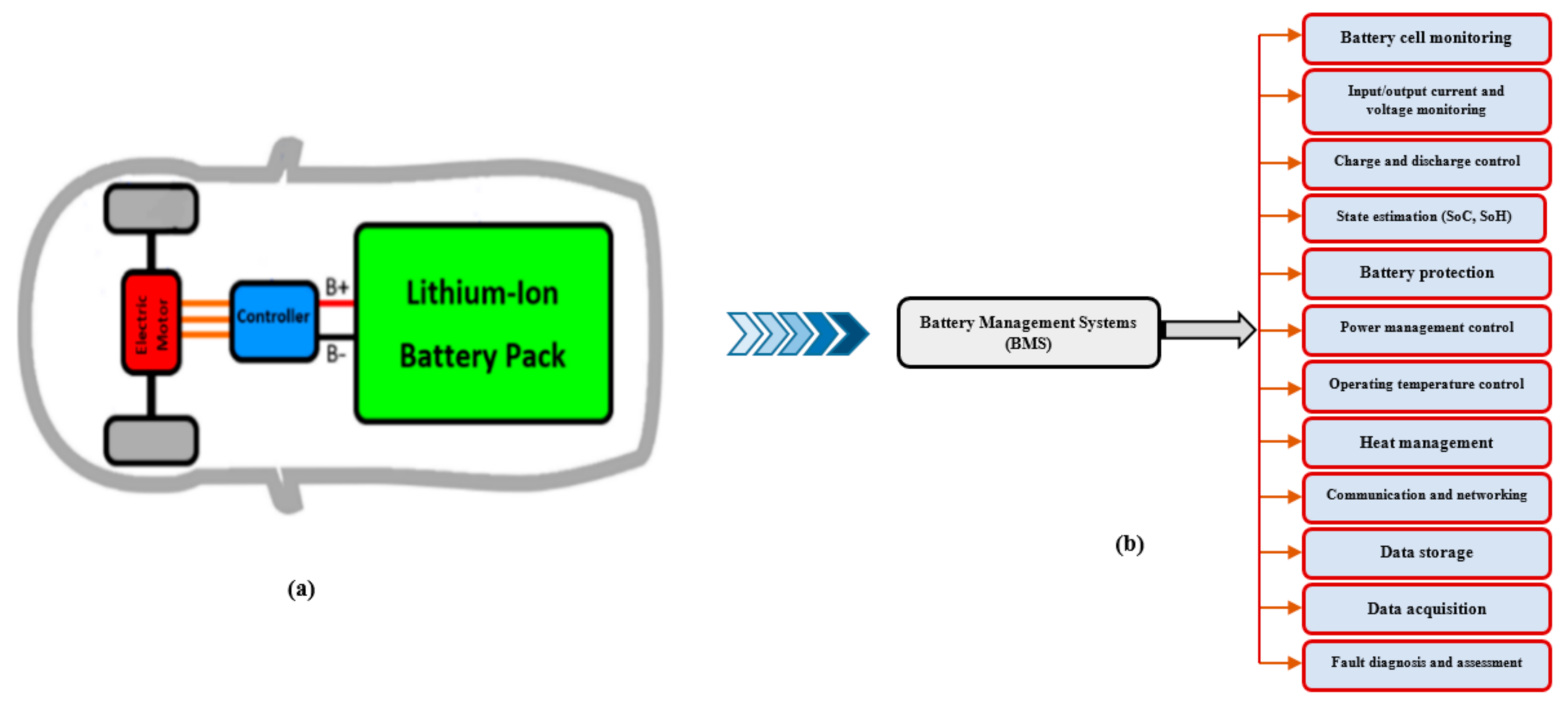

Lithium Ion Battery

Lithium ion (Li-ion) chemistry dominates electric vehicle batteries today at over 95% market share. High energy density, durability and charging traits make various Li-ion formulations ideal for packaging into battery electric vehicle (BEV) packs. Let’s look at the two most prevelant types:

NMC Lithium Ion Batteries

Composition: Nickel-manganese-cobalt oxide cathode + graphite anode + organic electrolyte

Models Using NMC: Tesla, Chevrolet, Nissan, BMW, Hyundai and more

NMC Battery Traits:

Energy Density – Excellent; high storage capacity relative to volume

Cycle Life – 1,000 to 3,000 cycles before significant degradation

Thermal Stability – Robust but cells require active cooling management systems

Recharge Rate – Medium speed capability enables flexible DC fast charging

As the dominant lithium ion formula for early EVs, NMC offers a robust blend of high capacity and voltage combined with reasonable charging rates – though cobalt is increasingly scarce and costly.

LFP Lithium Ion Batteries

Composition: Lithium iron phosphate cathode

Models Using LFP: Chinese brands like BYD plus niche models like BMW i3

LFP Battery Traits:

Energy Density – On par with NMC but lower nominal voltage per cell

Cycle Life – Extremely long at 5,000+ cycles with negligible degradation

Thermal Stability – Very resilient with safer chemical structure

Recharge Rate – Excellent compatibility with DC fast charging up to 4C charge rates

Cost – Affordable due to no cobalt or nickel

LFP presents very compelling longevity for second life reuse applications along with safer failure modes relative to NMC. However, the lower cell voltage requires more parallel groups increasing production complexity along with somewhat lower range capabilities.

Future blending with NMC may help overcome voltage deficiencies while retaining desirable LFP traits like long cycle life. Envision AESC and Enevate lead development of next-gen LFP innovations.

Future EV Battery Formulas

While variations of lithium ion dominate production EVs currently, next generation battery chemistries promise step-change improvements to energy density, charging rates, and manufacturing scale – pending commercial validation.

Let’s look at two highly anticipated alternatives eyeing production readiness in coming years:

Solid State Batteries

Composition: Lithium metal electrodes with solid ceramic electrolytes

Key Traits:

- 2-3X increased energy density

- Faster charging from greater thermal stability

- Safer failure modes without liquid electrolytes

By utilizing solid components rather than volatile organic electrolytes prone to thermal runaway challenges, SSB aims to pack more capacity in less space while enabling flexible ultra-fast charging.

QuantumScape leads pioneering development with claims of 80% capacity after 800 cycles at 15 minute charge rates. Commercial production with Volkswagen Group expected early next decade if validation continues successfully.

Lithium Sulfur Batteries

Composition: Lithium anode + sulfur composite cathode + polymer electrolyte

Key Traits:

- Extremely high theoretical capacity for 5X+ density gains

- Enables lighter, smaller battery packs

- Lower projected material costs than lithium ion

Lithium sulfur battery technology holds immense promise for both transportation and grid storage scenarios – if key hurdles around cycle life limitations from polysulfide shuttling can be overcome. Oxis Energy currently leads prototype development with ambitious claims of over 500 Wh/kg energy density and 95% capacity after 1,000 cycles.

Comparing Battery Chemistry Metrics

Let’s summarize key performance traits across prevalent and emerging EV battery types:

| Battery Chemistry | Maturity | Energy Density | Cycle Life | Thermal Stability | Recharge Rate |

|---|---|---|---|---|---|

| NMC Lithium Ion | Production vehicles since 2010. Still improving. | Good and steadily increasing | 1,000 to 3,000 cycles | Requires cooling systems | Decent for DC fast charging |

| LFP Lithium Ion | Early production. Gaining interest. | Comparable to NMC | 5,000+ cycles | Very resilient | Excellent, up to 4C peak |

| Solid State | Prototypesdemonstrating potential. Production ~2025 | Potential for 2-3X gains | Unproven long term | Excellent from ceramic electrolyte | Could enable 15 min full charges |

| Lithium Sulfur | Lab prototypes with low maturity | Very high theoretically | Currently limited; improving to 1,000 cycle target | TBD based on encapsulation | TBD |

In summary – while NMC and LFP lithium ion cells currently dominate, alternatives like solid state batteries and lithium sulfur have potential to disrupt EV markets during next decade if pioneering manufacturers can validate new technologies to enable mass production.

Battery Chemistry Trends and Forecasts

We’ve covered the landscape of existing and emerging EV battery technologies along with relative strengths around key factors. Now let’s summarize overarching trends and predictions around preferred chemistries through the next decade.

Near Term (2025) – NMC 811 & amp; LFP blended formulations dominate along with some early solid state introduction. Manufacturers balance cobalt and nickel challenges with performance gains. Volkswagen Group commits to fast-follow transition to SS adoption for highest energy densities as pioneers demonstrate viability.

Long Term (post 2030) – Solid state likely becomes predominant chemistry for premium vehicle models while enhanced LFP serves mass market. First lithium sulfur prototypes hit roads but require continued maturation before mainstream adoption. Continuing cost reductions and technical improvements across Li-ion families maintains capable performance for most needs as new battery types slowly get integrated into future vehicle platforms.

In summary, lithium ion cells will continue leading EV applications through next decade with significant incremental improvements before revolutionary new formulations like solid state batteries realize production readiness and cost competiveness necessary to fully supplant incumbent solutions at large scale. Expect a bridging period where emerging chemistries get integrated alongside mature lithium ion architectures rather than outright disruption.

Key Takeaways on EV Battery Chemistries

There remains vibrant global competition between automakers, aerospace firms, battery startups and electronics giants to crack code on optimized EV battery designs leveraging expertise from each industry.

Setting aside hype cycles around exciting but unproven new chemical formulations, lithium ion technology realistically has another solid decade of dominance powering electric vehicle drivetrains thanks to continual performance enhancements, manufacturing scale and incumbent advantages. NMC, LFP blends addressing localized supply chain and thermal traits offer accessible path to better mainstream adoption with 400+ mile ranges.

Longer term, migrating to architectures like solid state enabling faster charging, longer life and safer operation can unlock fuller decarbonization of transport sectors. But likely not before 2030 pending ongoing prototype validation.

Leave a Reply